VOR Private Capital Forecasting

Cash flow forecasting for private capital investments

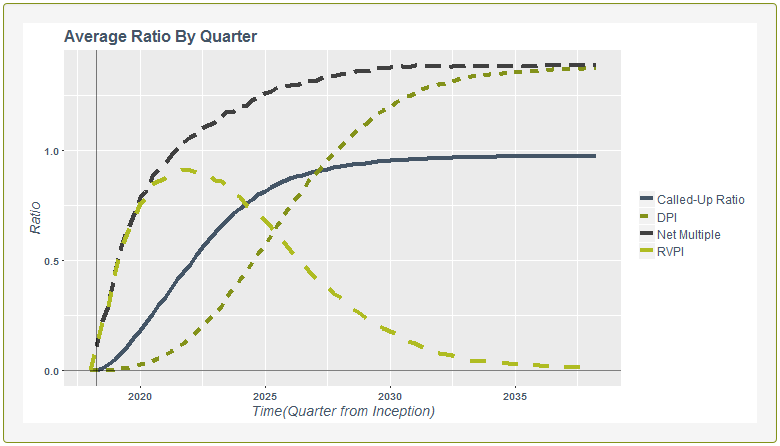

VOR Private Capital Forecasting (PCF) is a tool for analyzing the probability distribution of cash flows generated by private capital investments; equity, debt, and real assets. Next generation modeling techniques allow us to incorporate macro-economic data into cash flow models to better forecast the timing and magnitude of Capital Calls and Capital Distributions. Clients can analyze existing funds, hypothetical funds, and portfolios of private capital investments using their own market and economic assumptions. This facilitates the testing of various economic assumptions to understand the probable impact on fund cash flows and the portfolio.

Private Capital Functionality

Create scenario analyses to see how macro economic variables impact the distribution of cash flows from a portfolio of funds. Simulate Private Capital Cash Flows through time.

Quarterly Updates

Machine learning models are updated quarterly using industry leading data, helping your team understand the likely range of capital calls and distributions for future quarters.

A Better Picture

Create a portfolio of private capital funds for a picture of total private portfolio cash flows. Plan and manage liquidity requirements and future commitments.

Benefits

Simulate Cash Flows

Simulate Private Capital Cash Flows through time.

Portfolio View

Create a portfolio of private capital funds for a picture of total private portfolio cash flows.

Commitment Planning

Plan and manage liquidity requirements and future commitments.

Stress Testing

Stress test portfolios and funds to understand how dynamics change under different economic scenarios.

Machine Learning

Machine learning models updated quarterly using industry leading data.

Likely Cash Flows

Understand the likely range of capital calls and distributions for future quarters.

Build.Run.Illuminate

VOR Private Capital Forecasting is part of the VOR Risk Intelligence Suite. Contact us to learn more about how this suite of innovative modules can help guide your decision-making regarding risk management, efficient trading, and operational scale.