by Regitze Ladekarl, FRM | Jan 15, 2024 | Risk Report

Everyone knows that January is the time for sales. The market for government debt is no different. Come the new year, and countries around the world are looking to fund their budgets, which usually means that you can snag a good deal on treasury bonds. And in 2024 the...

by Regitze Ladekarl, FRM | Jan 8, 2024 | Risk Report

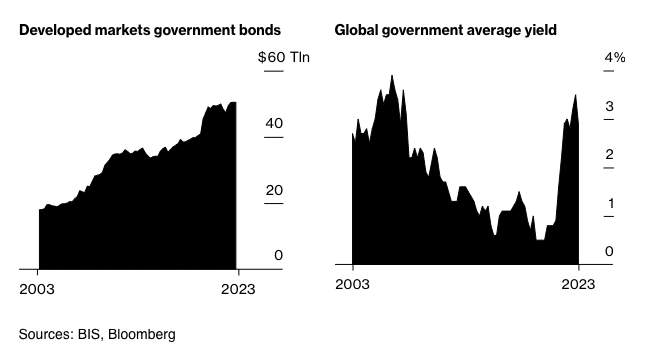

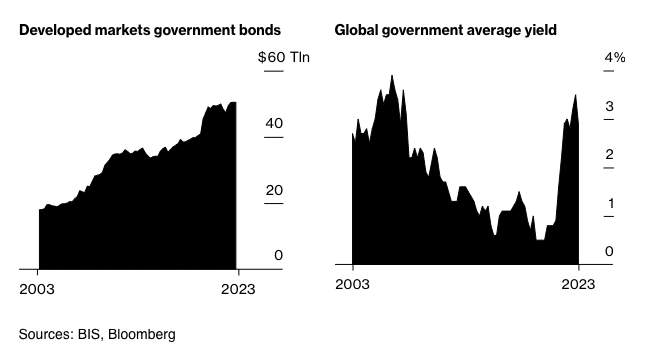

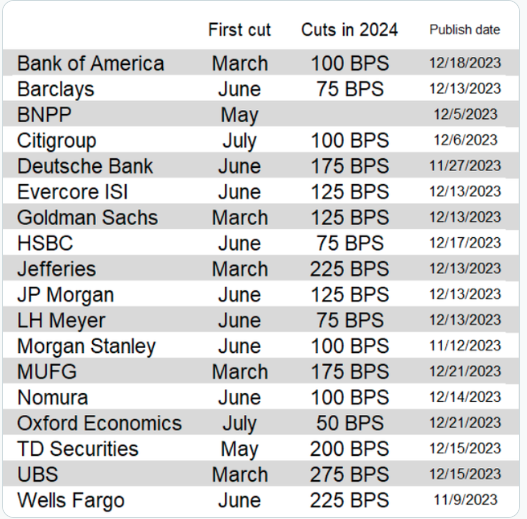

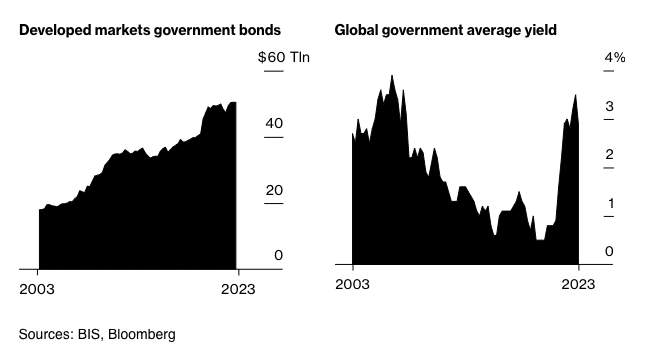

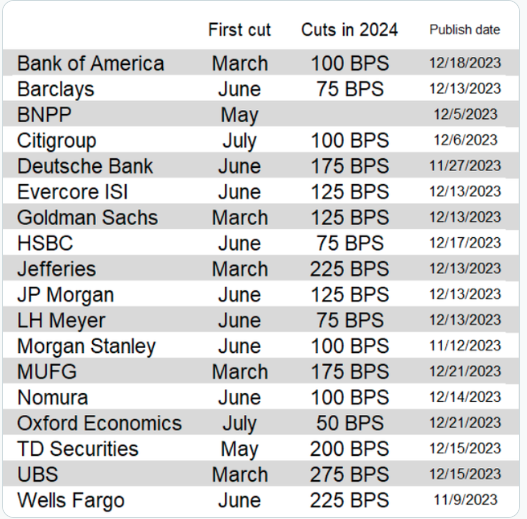

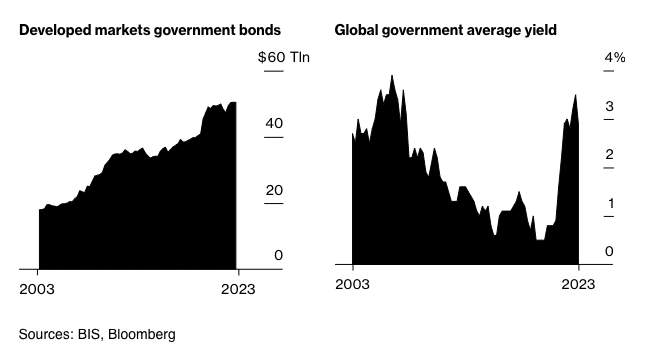

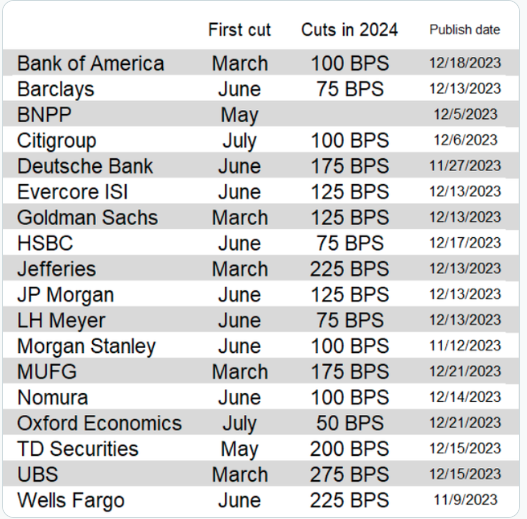

Source: Wall Street Journal Those are the questions for entering 2024. The importance of interest rates to the global economy in general, and to our clients in particular, cannot be stressed enough (ha-ha.) And last year was a bumpy road trip chasing the elusive soft...

by Jonathan Leonardelli, FRM | Jun 9, 2020 | Regulations

In a recent webinar I participated in with SAS we discussed Economic Impact Analysis (EIA). While EIA is similar in concept to stress testing, its main goal is to allow credit unions to move quickly to evaluate economic changes to their portfolio—such as those brought...

by Jonathan Leonardelli, FRM | Feb 21, 2020 | Business Analytics

Recently, I wrote about how a pandemic might be a useful scenario to have for scenario analysis. As I thought about how I might design such a scenario I considered: should I assume a global recession for the pandemic scenario? A pandemic, by definition, is an outbreak...

by Jonathan Leonardelli, FRM | Feb 13, 2020 | Business Analytics

A recent white paper I wrote discussed the benefits of scenario analysis. The purpose of scenario analysis is to see how economic, environmental, political, and technological change can impact a company’s business. The recent outbreak of COVID-19...