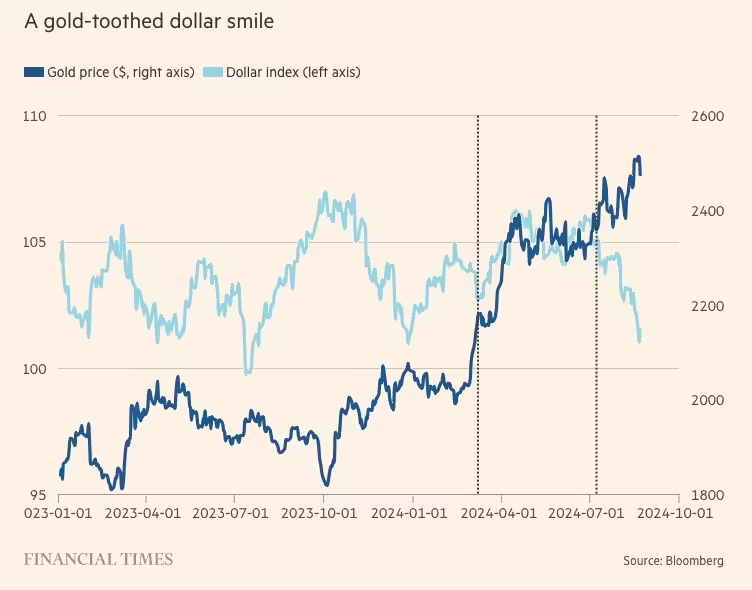

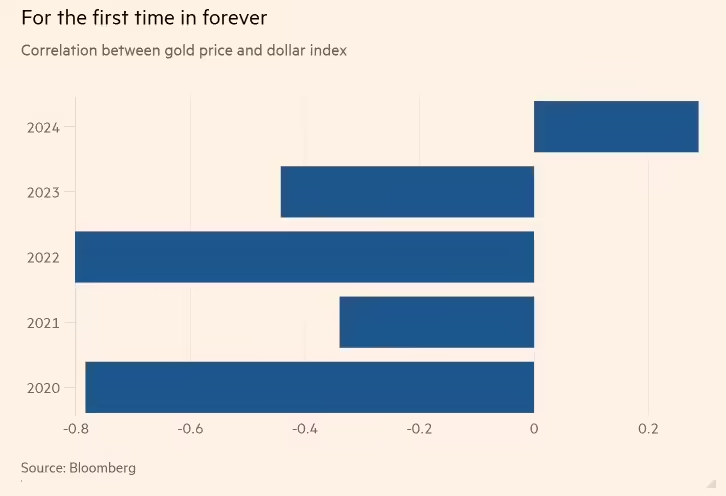

There used to be some correlations we could rely on; when you didn’t bring your umbrella it rains, they announce a new smartphone the week after you bought the latest one, and when the dollar is up, gold and oil are down.

So far in 2024, the gold price has gained more than the US stock market—which apart from the Big Selloff Flare has done great—and this week gold reached new record highs.

And therein lies the kink because the conventional wisdom has been that money flows to gold as a safe haven in times of economic stress and downturn and right now, we don’t seem to have either.

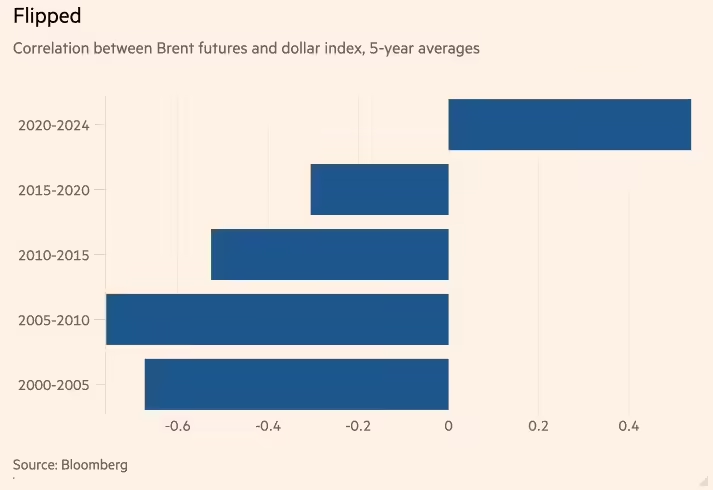

Same with oil and dollar. The oil price is denominated in US dollar, so when the oil price goes up, the oil we need costs more (duh!) And the more we import oil, the higher the demand and price, and dollars leave the US while other currencies flow in, which weakens the USD (less duh!)

This week, FT floated the idea that the correlation breakdown is structural, not cyclical. There are some major old truths that are not true anymore:

- The Chinese economy grows by double-digits

- Inflation is a problem of the past

- The US is a net energy importer

- Mature democracies are politically and economically stable

Instead, it is complicated.

The Chinese economy is not doing awesome. Especially commercial real estate is in free fall and has dragged everything else with it. That means Chinese investors have bulked up on gold.

So has central banks across the world because the dollar has been a darn expensive hedge due to the US solo act of #higherforlonger. With rates about to come down—when and how much TBD—gold has gotten another boost because lower yields make gold (relatively) more attractive.

And don’t even get us started on inflation!

Just note that energy inflation was a frontrunner for the Big I because of OPEC supply cuts and sanctions on Russia. If it hadn’t been for US more than filling the gap and becoming a net gas and oil exporter, it could have been the late 70s all over, and we would have to wear crocheted bellbottoms again.

The positive correlation between oil and dollar prices now double-punches energy-importing countries, fueling inflation and slowing growth, and triple-punches those who also have dollar-denominated debt.

Regitze Ladekarl, FRM, is FRG’s Director of Company Intelligence. She has 25-plus years of experience where finance meets technology.