Don’t you just love it when, at the end of a soap opera season, it turns out that the four side-stories are connected, and the manager from the corner store is the long-lost twin* of the heir to the billion-dollar empire, and they will now have to share the fortune once Rick Blakington Sr. dies? Well, this week is a bit like that (except for the twin part).

So, we have talked about banks transferring risk off their balance sheet to bring down regulatory requirements. We have also talked about the rise of private credit as an eager buyer of that risk. And, we have talked about how banks—especially in Europe and Asia—are under new rules and reputational pressure to cut down on emissions in the effort to reach global net zero emissions by 2050, and that most of the bank emissions are scope 3, which means that they come from the banks investing in and financing fossil fuel-intensive industries.

Bloomberg published a piece about how all of this comes together with the banks to a growing extent collaborating with private credit managers on their high-emission client accounts. It is a three-way win; the banks get to maintain their profitable client relationships without the expensive risk, which the private credit managers take over, and the clients keep their finance costs down because their access to credit doesn’t run dry.

Our friends at Preqin report that they know of $9BN worth of oil and gas deals in 2022-2023 that were struck with private debt, whereas only $450MN in the two years before that.

The only snags with this share/care fest are that it obviously doesn’t bring much of a transition to a net zero state about, and that the risky business now takes place in less or non-regulated territory.

And this is not the only area where transition goes slower than intended.

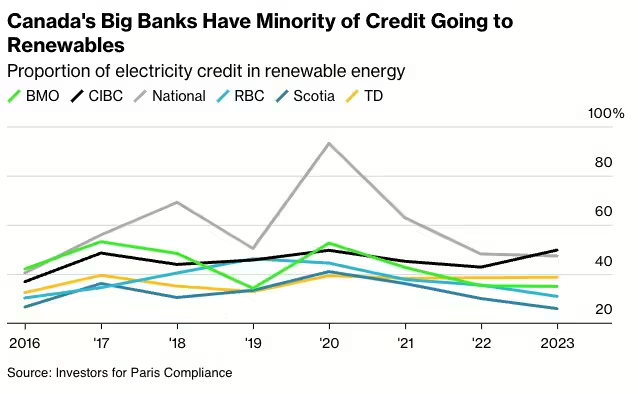

The organization Investors for Paris Compliance writes in a new report that just three of Canada’s largest financial institutions fulfill the Paris Agreement goal to have 71% of their total utility financing and investment in renewable energy.

The big Canadian banks lag even further behind. Only CIBC has increased the proportion of renewable energy within their electricity credit since 2022.

Investors for Paris Compliance, which advocates for net zero transition through investment in Canadian companies, calls for stronger voluntary guidelines as well as financial-sector regulations to help speed things along.

Cuz the players gonna play, play, play, play, play

And the haters gonna hate, hate, hate, hate, hate, hate—Taylor S.

*despite them looking nothing alike because one of them has had extensive plastic surgery after a freak accident involving a toaster, a bald eagle, and a Phillips screwdriver…

Regitze Ladekarl, FRM, is FRG’s Director of Company Intelligence. She has 25-plus years of experience where finance meets technology.