Much has changed since CECL became effective—data has grown, technologies have advanced. While those changes themselves may cause a Financial Institution (FI) to reevaluate its CECL system a more important motivator might be experience.

For most FIs, the CECL process has been running for years and as is common with most first-time processes, the users have found improvements. Are these changes enough to call for a system refresh? Maybe not alone. But coupled with other changes perhaps it’s time to move the system to the next generation so that it meets both needs and wants.

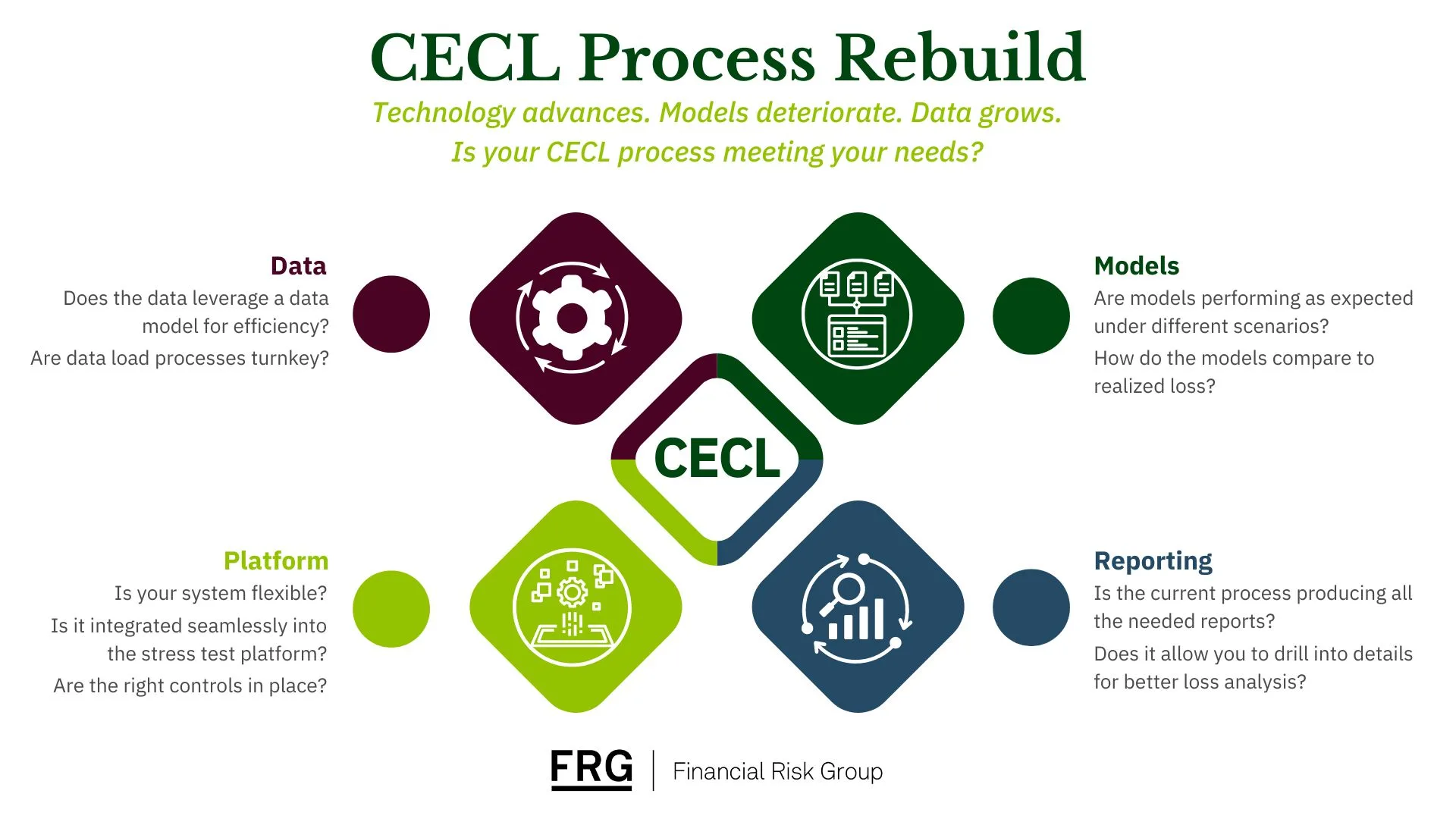

Your CECL system should speed, simplify, and support your initiative through:

Data: Streamline your data load process and standardize data formats to simplify CECL calculations and reporting.

Models: Rebuild your models if performance deterioration occurs or there is a need to better identify sources of credit risk.

Platform: Ensure your CECL system is flexible and scalable to accommodate future needs and stress test integrations.

Reporting: Enhance your understanding of portfolio loss areas with dynamic and customizable reporting capabilities.

Data: Streamlining the Process

Data’s importance to a CECL system can be obvious and not so obvious. The obvious aspect is that specific data is needed to calculate the expected credit loss amount. The not-so-obvious aspect is data’s impact on the efficiency of the process.

Implementing methods to automate data ingestion and validation can minimize errors and reduce processing time. One such method is having standard data structures—one for data delivered to the system, the other for storing the processed data for the CECL run. The former ensures accuracy and consistency of data for all runs; the latter ensures more seamless updates to the platform.

Platform: Flexibility and Scalability

Speaking of platforms, the ideal CECL system should be one that is flexible and scalable. This ideal is driven by two factors: future changes in requirements and how ECL feeds into other FI initiatives.

In March 2022 FASB amended the CECL requirements. FASB dropped the troubled debt restructuring (TDR) accounting model and required FIs to report current-period gross write-offs by vintage. These are the first; more changes are likely because of the evolving nature of the financial industry.

The CECL system, directly or indirectly, also ties into stress testing. Regulators require the stressed capital projections process (e.g., CCAR) use the same method to calculate ECL as that used by the quarterly CECL runs. Another initiative is climate risk. In other countries regulators are giving guidance on how climate transition risk can be incorporated into ECL. Perhaps the same will happen in the US. Having a system that can accommodate the needs of these initiatives, and others, prepares a bank for quick and informative risk assessment.

Models: Evolving with Time

A model’s lifespan is unknown when it is initially built and implemented. To help with that determination FIs use model monitoring to gauge how well the model compares to reality. If deterioration is seen by them over a series of quarters, then a model refit or rebuild is justified.

Waning model performance is not the only thing to consider. Another is the granularity of the model. Aggregate models have their place, but ones that are more granular and segmented will help pinpoint sources of credit risk. With time having passed since the initial model build, enough history may be available to revisit these options.

Reporting: Customization Is Everything

CECL reporting is more than the last step to the CECL process. It is a way to obtain insights into portfolio performance and risk concentrations. A reporting tool that is customizable is essential for dynamic analysis and decision making. FIs should prioritize systems that allow easy adjustments to visualizations and reporting parameters to help targeted investigation into areas of concern. Having a reporting process that is flexible now not only satisfies the current needs but ensures future needs can be met.

Conclusion: Navigating the CECL Journey

Having the right CECL system is a critical step in satisfying the regulation while allowing for better risk awareness at the FI. From data processing to reporting capabilities, each part plays a crucial role to achieve these goals. Imbuing the first CECL system with the characteristics described above sets the stage for the FI to adapt and innovate in an era of constant change.

Jonathan Leonardelli, FRM, Director of Business Analytics for the FRG, leads the group responsible for model development, data science, documentation, and training. He has more than 20 years’ experience in the area of financial risk.