The Fed cut its target rates this week.

It was long-awaited and bigger than expected, both literally and symbolically.

In number terms, the rates were lowered half a percentage point. In meaning terms, the rate cut was a turning point into the rarely visited Soft Landing Territory.

Think of what the Fed is trying to do as cutting the wires of two economic bombs (recession and overheating) with clocks ticking in opposite directions (unemployment and inflation) using only stoic confidence and a pair of scissors (rate cuts).

If they succeed, the economy will reach a nirvana state of low unemployment and low inflation at the same time, and unicorns with flowers in their manes will flood the streets to do the Chappell Roan TikTok dance.

However, it is not as if the bomb clocks will stop ticking right away.

First, it will take some time for Wednesday’s rate cuts to reverberate through to the labor market to keep employment going. And the Fed can’t do it any faster because then it might set off inflation again.

Second, research shows that the sweet spot where the economy is neither growing nor slowing is at a rate level of 3.5% – 4.8% so the Fed most likely has a bit more work to do. That also showed in the dot-plot from Wednesday’s meeting.

The dot-plot shows where the 19 members of the Federal Open Market Committee (FOMC) estimate the Fed funds rate should be at the end of each of the next three years and long-term.

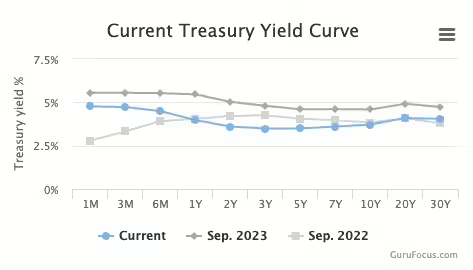

Third, the stoic confidence is just as important as the scissors because the cuts happen to short-term rates and the financial markets have to believe in them to form happy expectations for long-term rates so the yield curve can stop looking like a potbellied pig.

Remember, an upward-sloping yield curve signals economic growth, an inverted (downward-sloping) curve signals recession, and a potbelly could go either way.

So, here is to hope for unicorns over pigs, and a steady Fed hand going forward.

Regitze Ladekarl, FRM, is FRG’s Director of Company Intelligence. She has 25-plus years of experience where finance meets technology.

This article is part of the FRG Risk Report, published weekly on the FRG blog. To read other entries of the Risk Report, visit frgrisk.com/category/risk-report/.