This blog series explores initial industry research into managing climate risk so that you understand what is at stake for your financial institution (FI), as well as how to get started with measuring and mitigating this emerging source of risk.

We have presented an introduction to the risk that climate change poses to the financial industry, and an overview of the key entities who are providing climate information, scenarios and policy information you may find useful. What can your financial institution (FI) do with this information?

The regulators who will be asking you how much of your portfolio is at risk because of climate change seem to have identified stress testing and what-if scenario analysis as the preferred overarching methodologies for answering this question. Your FI’s very first step is identifying resources, whether internal or external, that can help you get started along this journey based on emerging best practices.

These resources can be consultants, climate scientists, technical papers, economic narratives related to climate, climate scenarios, socio-economic research or reputably sourced articles, to name a few types. Valuable resources are a subset of these that simultaneously settle your nerves, teach you something you didn’t know before, and offer a path forward. Here’s hoping you find this blog a valuable resource as a starting place.

The following is a suggested path forward: a roadmap laid out step-by-step to help you and your FI start to consider the risks presented by climate change. The structure we suggest below will combat the uncertainty you may initially have with the subject of climate risk. You won’t have all the answers—even the experts don’t— but at least you’ll be asking the right questions.

Form a cross-functional steering committee to handle your financial institution’s management of climate risk. At a minimum, representation should include risk teams, finance teams, economists, internal audit and even marketing. No one team will have all the information and experience required upfront. For many financial institutions, the formation of a dedicated climate risk team is advisable, and having a steering committee already formed will allow for the identification of the most engaged contributors and should allow for the future creation of such a team with people from varied backgrounds somewhat easier.

Break some ground with the physical risk associated with climate risk. Consider partnering with climate scientists. These disciplines generally do not exist within financial institutions, but still need to be consulted. For example, you may be able to quickly develop a model which estimates the incremental credit risk impact of a tornado on a local customer base. A climate scientist can help you identify those regions most likely to experience increases in tornadic events over the next 30 years, something you would need for stress testing physical impacts of climate risk.

Narrow your scope:

- Focus on either physical or transition climate risk. From our experience, central banks and regulators are so far focusing on transition risk due to claims that it is the more immediate of the two types.

- Source climate scenarios from NGFS for transition risk or Climate Analytics for physical risk. But your central banks or other regulators may have their own takes on climate scenarios. You’ll want to use the scenarios created by the most closely relevant source in order to not have to duplicate effort. However, it’s likely that any set of scenarios is somewhat informed by the scenarios created by NGFS or Climate Analytics.

- Pick a loan portfolio segment that sounds interesting to you. In our experience, choosing between a consumer loan portfolio and a commercial portfolio will lead you in different directions . Choosing between products – e.g., auto loans or mortgages – will also lead you in different directions.

- Study the scenario narratives. Visualize the scenarios. Familiarize yourself with the meanings of the included variables. The steering committee will come in useful here. Start with a few variables that you can draw a logical connection with credit risk. Selected variables may be different depending on whether you chose a consumer or commercial portfolio.

- Narrow your portfolio segment to a specific region, no bigger than a country, but smaller may be advisable. Smaller regions will force you to think through some special regional idiosyncrasies and data challenges.

Be careful. While the narrowed scope will have simplified the problem and removed noise it also raises the specter of selection and confirmation biases. Therefore, any results you find will only be applicable to the smaller scope. That said, while cycling through this narrowed scope, and thinking through these idiosyncrasies, keep in mind you likely need to uncover a possible methodology that can be generalized to other regions, sectors, and scenario variables.

Estimate the credit risk impacts of climate risk on your portfolio. This is the meaty part, for sure, and is, very much, the key that is missing from most literature out there. Your cross-functional committee and dedicated team are there to offer perspectives you don’t have yet. Here’s one way to start:

- Call a meeting for your steering committee. Communicate the narrowed scope you’ll focus on so that everyone can prepare. You’ll want them to consume research and other resources that examine the climate risks (or benefits) related to the scope you’ve pre-defined and from within the viewpoint of their specialty.

- Present the scenarios one-by-one to the steering committee. Ask them how the scope (product, portfolio segment, region, sector, etc.) might react if the scenario comes to pass.

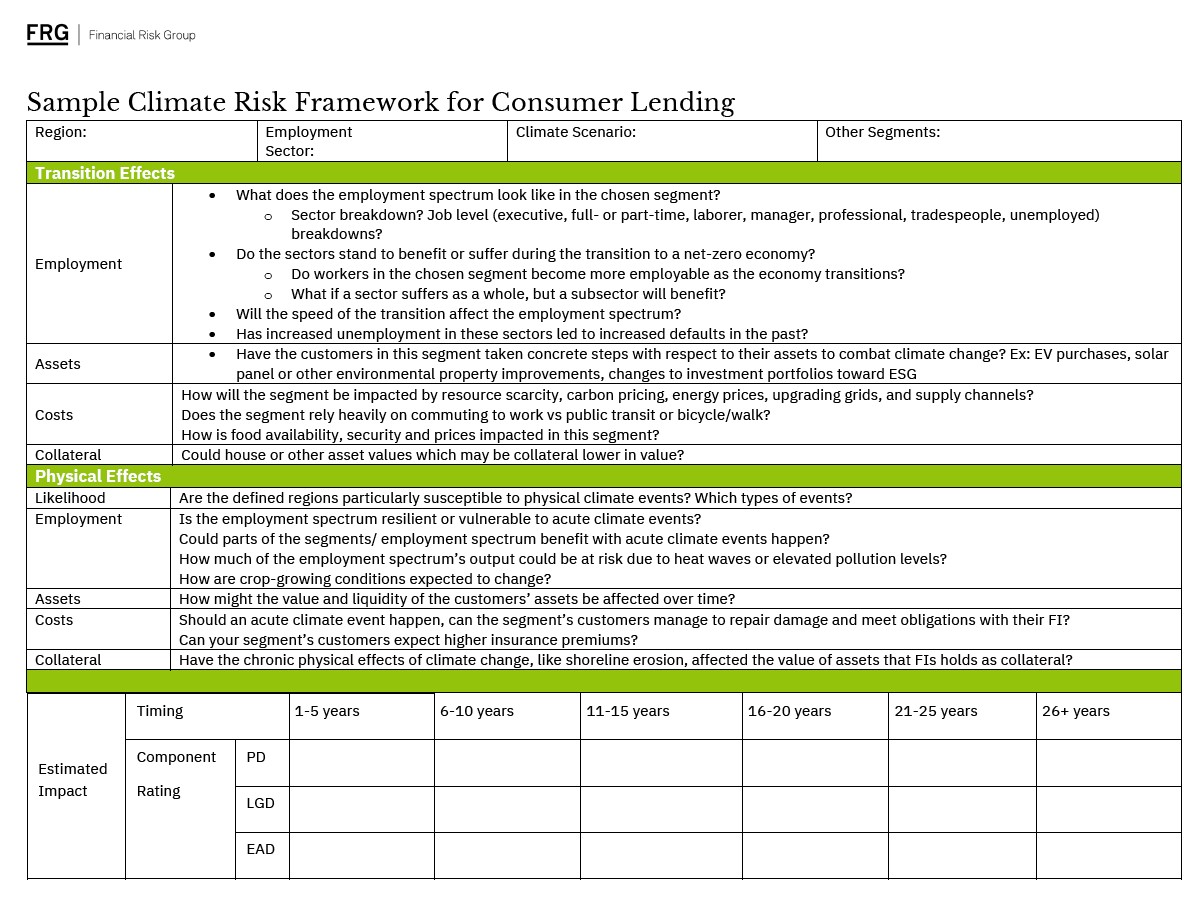

- Complete a climate risk susceptibility framework. We have one here for download here, and it’s certainly customizable. Estimate the selected combination’s susceptibility to each dimension of physical or transition risk. Don’t forget the possibility of a positive! Which part(s) of credit losses might be impacted? You’ll also need to predict how the scenario variables behave over time. Even two scenarios that attempt to achieve the same goal for planetary warming can arrive at the finish line in different ways. The speed at which they achieve the goals could be the most important thing.

- Narrowing your scope was as much about focusing your efforts as it was about thinking through what a segmentation of regions and sectors might look like. In the end you’ll want to complete a framework for each segment, region, scenario complete with estimates of the impact to the factors of credit loss. That will be a big exercise, so prioritize segments with the biggest impacts on large regions and sectors and collapse segments together where possible.

- Translate the impact estimates into stress factors for PD, LGD and EAD. We suggest starting this by setting goal posts. What are your most at-risk segments? What are your least at-risk? With all the information you have, take the leap and set the maximum and minimum stress factors. Then, interpolate for the rest. Run through a stress test scenario for your highly prioritized segments. Take a breath.

- Finally, initiate the actions that will take you from your subjective analysis to an objective one:

- Revisit your climate risk frameworks periodically. Are your goal posts still appropriate? Are sectors performing as expected? Have there been technological improvements within the segment?

- You’ll start to collect data that you can use to model the impacts. From here on in, you should be in familiar territory!

Scenario analysis with climate risk data isn’t meant to yield a forecast or a prediction, but a possibility. Financial institutions can use these what-if scenarios to plan, knowing that their analysts have taken great care to ensure the relationships between climate data and credit risk are economically consistent. Importantly, however, financial institutions must also take care to understand the limitations of their analyses, especially when the imposed direction and strength of the relationships between climate risk data and credit risk drivers are still theoretical.

While scenario analysis is a good start, the industry must begin to make decisions at the customer level using climate risk data to assess those situations that institutions did not normally differentiate between. Consider the following:

Two mortgage applicants approach your institution with seemingly identical credit histories. The houses they wish to purchase are very similar and the purchase price and their down payments are the same. If the financial institution knew:

- That one applicant is employed in a carbon-intensive industry;

- That one house is located in an area prone to flooding;

- That one applicant’s job is outdoors and labor-intensive; or

- That one applicant intends to place solar panels on the property

You might figure that the lending institution would be able to reliably predict which direction, positive or negative, any impact to risk would lean in the context of climate change. However, it would be very difficult to quantify the impact, let alone the impact of overlapping factors.

Nonetheless, this is what the financial industry needs to do, both to protect themselves in the face of climate change, and to nudge (or push) society and industry toward environmental sustainability through more appropriate pricing of risk and refinement of risk appetites.

We hope that what we have shared with you has provided some context on the issues faced by the financial industry related to climate change and some concrete steps forward. Curious credit risk professionals are already equipped with a lot of the needed tools. This subject is a great way to generate enthusiasm and make the work your risk teams do more interesting and diversified.

Although varied portfolios will face varying levels of risk, in a lot of ways, we are all strapped into the same roller coaster. Let’s make sure we pay attention to the gravity of the situation and have a safe ride. As always, FRG is here to help you manage these risks, contribute to the health of the planet, and come through even more resilient on the other side.

In future installments, we plan to dig into the following subjects at a deeper level.

- Bridging the gap between climate scenarios and risk analytics

- Retooling a stress testing platform for climate risk

- Climate-adjusted risk scores

Additional Reading

Scenarios in Action – A progress report on global supervisory and central bank climate scenario exercises

NGFS Climate Scenarios for central banks and supervisors

https://www.ngfs.net/sites/default/files/media/2021/08/27/ngfs_climate_scenarios_phase2_june2021.pdf

Beyond the Horizon – New Tools and Frameworks for transition risk assessments from UNEP RI’s TCFD Banking Program

https://www.unepfi.org/wordpress/wp-content/uploads/2020/10/Beyond-the-Horizon.pdf

Using Scenario Analysis to Assess Climate Transition Risk

National Centers for Environmental Information – May 2022 National Climate Report

https://www.ncei.noaa.gov/access/monitoring/monthly-report/national/202205

States at Risk – National Summary

https://assets.statesatrisk.org/media/NationalSummary.pdf

The Best & Worst States for Climate Change in the U.S.

https://www.safehome.org/climate-change-statistics/

Earth Temperature Timeline

Joey Doyle, business analytics consultant with FRG, has more than 15 years of experience in risk analysis. With a background in pure mathematics and education, Joey tends to build analytics from the ground up using first principles and innovative thinking. His experience includes modelling, strategy, provision and stress testing analytics.

RELATED: