This is by far one of my favorite German words. The direct translation is dark doldrums, and if that doesn’t say everything there is to say, I don’t know what does.

Dunkelflaute’s more modern meaning is a period of time, often several days, with little or no sunlight or wind making it difficult to generate certain renewable energies. This weather phenomenon is common in northern Europe and Japan.

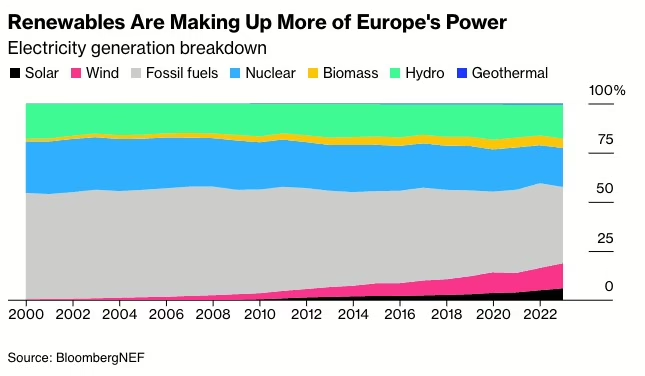

As we have mentioned before, Europe is the fastest-warming continent, and renewable energy is now so prevalent there, that weather events such as Dunkelflaute (yes, I’m just gonna keep saying it) impact energy prices and thus energy trade. Earlier this year, it sent German electricity prices skyrocketing, only to plunge into the negative in several countries in early March because of a sunny boost to solar parks.

That sort of market volatility makes an accurate weather forecast all the more important. And luckily there is a new AI for that.

The European Centre for Medium-Range Weather Forecasts (ECMWF) went live with their Artificial Intelligence Forecasting System (AIFS) at the end of February, and Junge, does that set some new standards:

- Its two-week forecast is global and used around the world

- It is an open model

- It outperforms state-of-the-art physics-based models in terms of accuracy with up to 20% on some measures

- It is significantly faster than traditional models (down from 30 to 3 minutes for a raw two-week forecast)

- It uses 1,000 times less energy to generate a forecast

While it is a promising start, the AIFS cannot replace conventional models—yet. Things like cloud cover, dust, and some extreme weather events are still a challenge for it, and it only generates one forecast at a time. The next version aims to generate an ensemble (50) predictions per run.

However, energy traders and power suppliers will definitely take what they can get.

“[The two-week forecast] is what markets move on most,” said Dan Harding, a meteorologist at the weather analytics firm, MetDesk, to Bloomberg.

Who knows, soon Dunkelflaute’s market impact might be a thing of the past, and we will have utter Fröhlichkeit. It just doesn’t have the same ring to it.

Regitze Ladekarl, FRM, is FRG’s Director of Company Intelligence. She has 25-plus years of experience where finance meets technology.

This article is part of the FRG Risk Report, published weekly on the FRG blog. To read other entries of the Risk Report, visit frgrisk.com/category/risk-report/.