We all know how it started.

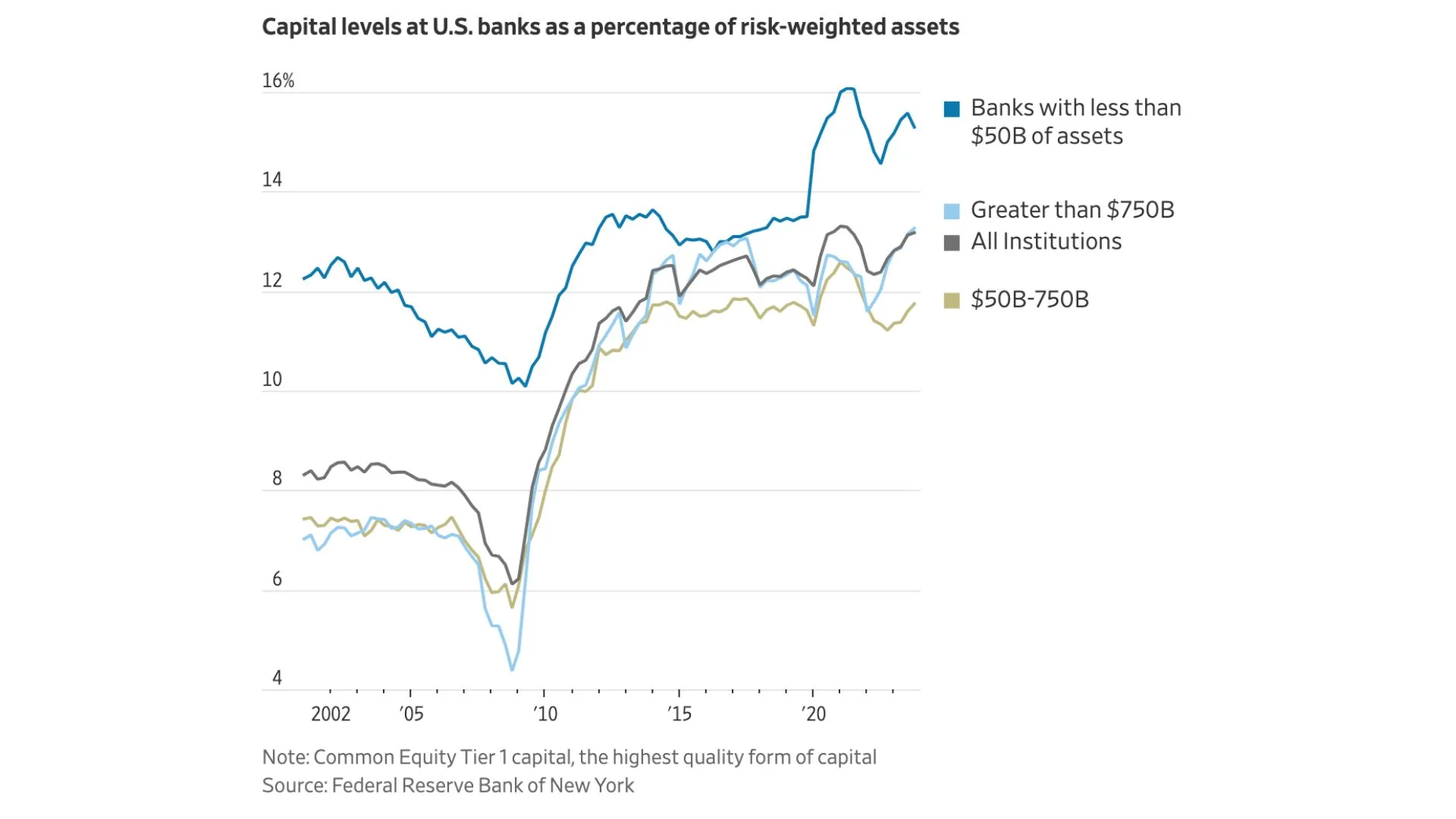

Last summer Team Regulator slammed Team Bank hard with a proposal that among other stingers would mean an almost 20% increase—AKA $150bn—in the core capital requirement for Club G-SIB.

A G-SIB is a Global Systemically Important Bank. The current US ones are Bank of America, BNY Mellon, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, State Street, and Wells Fargo.

A scrub is a guy that thinks he’s fly

And is also known as a busta

—No Scrubs by TLC

Team Bank was having exactly none of that.

Led by JPM Dimon, they hit back on all the channels. They free-styled in earnings calls. They flooded the comment section of the proposal. They put on TV ads during football games. They even went above the Fed’s M-Barr (who championed the prop) and straight to his boss, Jerome Powell, because that’s how the top dogs bark. Like That.

I have not felt bereft of attention from the banking lobby

—response track by Michael Barr

And this week an anonymous bro of Team Regulator let it slide to WSJ that they are working on a new-new proposal that could slash that cap req increase in half.

Meanwhile, Committee B dusted off a paper from 2018 that says that non-banking, neo-banking, and all sorts of shadow banking come with risks, and those risks should be regulated in the same way as trad-banking.

Same Risk,

Same Activity,

Same Regulation

—Digitalization of Finance by BCBS

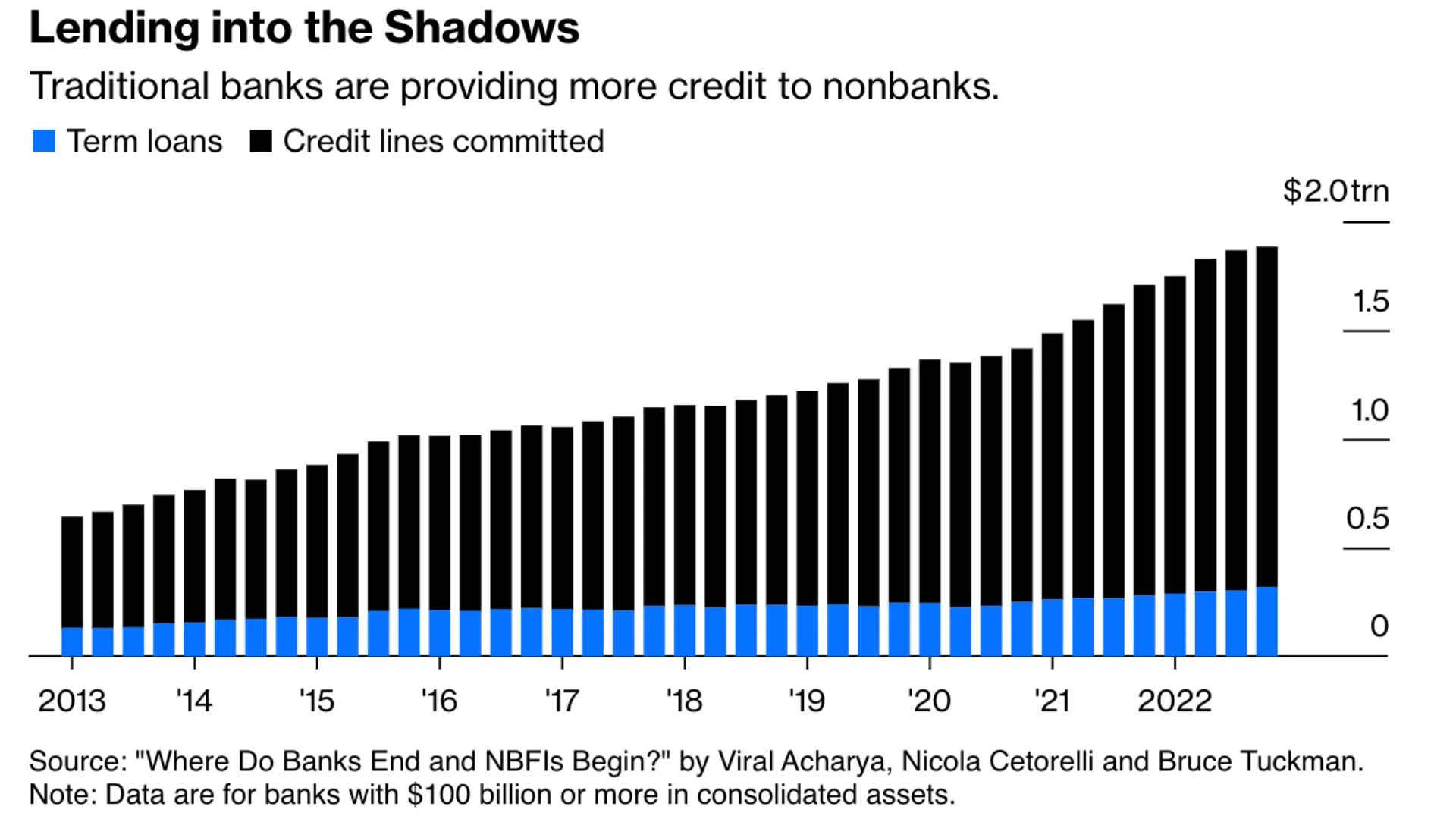

The Ed Board at Bloomberg went even further by suggesting that traditional banks lending to shadow banks should not be first in line for bail money from the Fed.

The amount that traditional banks have lent to shadow banks has more than tripled in the last decade which could be a short fuse in a new GFC.

Lastly, The Union threw down the final text on its AI Act that, in a true signature move, has a double-wide definition of systems, which easily features those of the stochastic persuasion (like, for example, credit risk models), and puts the obligations first on the providers (developers) and second on the users (deployers). Mo’ tech, mo’ work, as the notorious say.

‘AI system’ means a machine-based system that is designed to operate with varying levels of autonomy and that may exhibit adaptiveness after deployment, and that, for explicit or implicit objectives, infers, from the input it receives, how to generate outputs such as predictions, content, recommendations, or decisions that can influence physical or virtual environments;

—AI Act by the European Union

Regitze Ladekarl, FRM, is FRG’s Director of Company Intelligence. She has 25-plus years of experience where finance meets technology.