VOR Risk Premia

Create, optimize, and track your risk premia portfolio

World-class analytics power the system giving you powerful options to build your portfolio. Our proven technology currently runs over $2 billion in risk premia strategies.

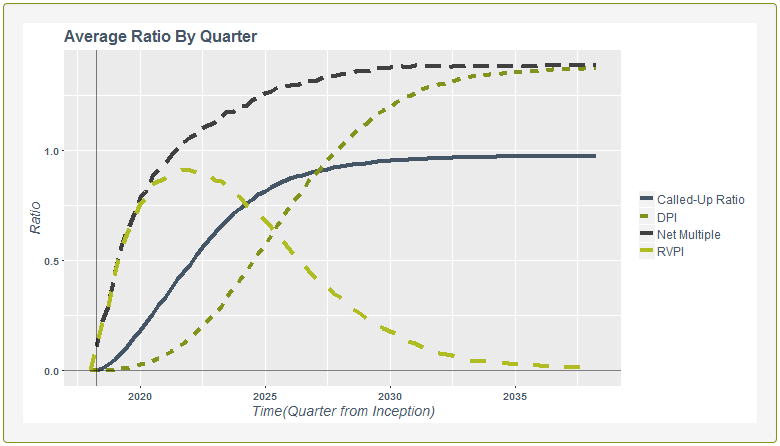

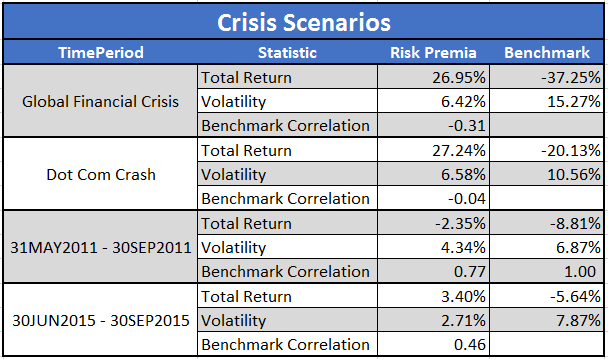

Risk Premia Overview

Improve portfolio dynamics and increase potential return opportunities. The addition of uncorrelated strategies to a traditional portfolio allows for better risk / return characteristics.

Case Study

“At the outset, agile prototyping allowed FRG to design, test, and implement each portfolio management function speedily in VOR modules. Now FRG’s technology and risk professionals manage the client’s data and respond smartly to special requests for analytical assistance.”

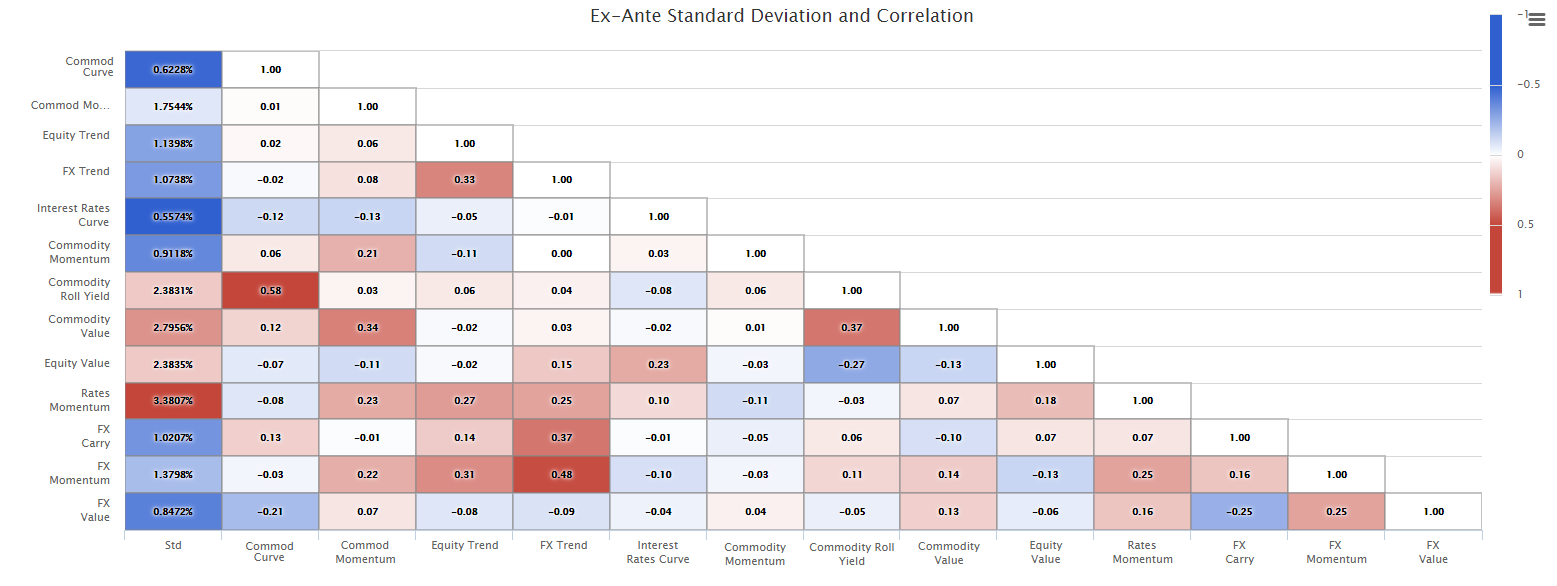

World Class Analytics

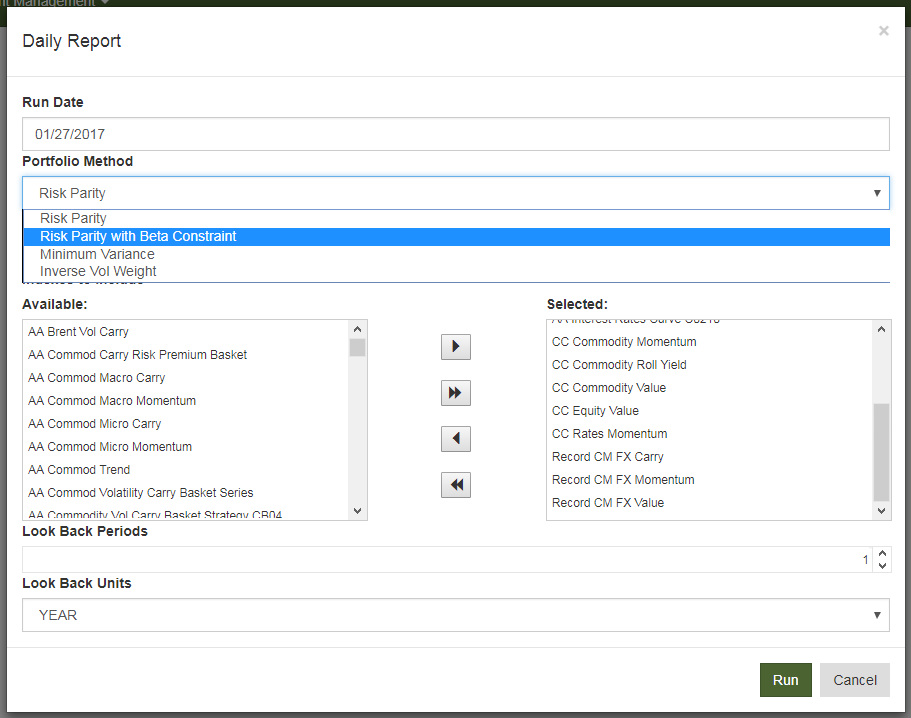

VOR Risk Premia allows you to easily incorporate custom analytics and methodologies into the platform. Automated reports alert you when portfolio thresholds are breached.

Customized Web Interface

VOR Risk Premia captures, loads, and presents all relevant data from a single source. Your staff can access risk premia data, portfolio management tools, and historical reports for any as-of date.

Benefits

Portfolio Management

Customizable tool for the management of systematic portfolio strategies.

Portfolio Construction

Optimized and heuristic construction techniques available with the ability to define new methods as required.

Portfolio Monitoring

Hold and monitor your portfolio on a daily basis. Automated reports alert you when thresholds are breached.

Single Data Source

Captures, loads, and presents all relevant data from a single source. Access data, portfolio management tools, and historical reports for any as-of date.

Managed Service

FRG manages all aspects of the system, from data loading to running calculations.

Unmanaged Service

Clients upload their data and manage the portfolios. FRG offers tech support as required.

Build.Run.Illuminate

VOR Risk Premia is part of the VOR Risk Intelligence Suite. Contact us to learn more about how this suite of innovative modules can help guide your decision-making regarding risk management, efficient trading, and operational scale.